Certified. Acknowledged. International.

Our Latest Blogs

Finance Manager

How a Business Finance Manager Can Drive Strategic Growth?

In today’s mercurial business environment, companies cannot rely solely on intuition, gut feeling, or tradition to chart a course for future growth. Strategic decisions—whether to enter new markets, launch products, invest in technology, or expand capacity—depend heavily on financial insight, disciplined planning, and risk foresight. A Business Finance Manager is uniquely positioned at that intersection of operations, leadership, and analytics. When empowered and forward-looking, such a finance leader becomes not simply a guardian of cost and compliance but a catalyst for growth, innovation, and sustainable value creation.

Too many organisations relegate the finance function to its traditional tasks—budgeting, reporting, oversight—treating it as a back-office cost centre. But the modern finance manager must evolve into a strategic partner: working hand in glove with marketing, operations, R&D, and leadership to align financial capital to business ambition. By leveraging forecasting, scenario planning, performance metrics, capital allocation, and stakeholder communication, a finance manager can steer strategy from the inside out.

Financial Planning & Scenario Modelling as a Strategic Compass

The foundation of strategic growth lies in credible projections and scenario-based planning. A capable finance manager builds dynamic financial models that simulate multiple futures (e.g. optimistic, base, downside). These models allow leadership to stress-test plans, identify bottlenecks, and compare alternative paths (for example, investing in a new product vs expanding capacity). In mature organisations, the strategic finance function often goes beyond standard FP&A, integrating long-range planning and “what-if” analyses that shape major capital and operational decisions.

By introducing sensitivity analyses (e.g. what if sales growth is 20% lower, or input prices rise), the finance leader helps the business remain resilient under uncertainty.

Capital Allocation & Investment Prioritisation

Growth is not just about revenue — it is about smart deployment of capital. A finance manager must develop a framework for evaluating competing investment proposals (new product lines, geographic expansion, M&A, and infrastructure). Using metrics like net present value (NPV), internal rate of return (IRR), payback periods, and risk-adjusted returns, the finance leader can prioritise those initiatives that maximise long-term value.

Moreover, the finance manager must balance debt vs equity, optimise the capital structure, and manage working capital tightly so that cash is not idle or over-leveraged. The choices made here significantly influence the company’s agility to pursue opportunities or respond to threats.

Business Partnering & Cross-Functional Influence

Finance should not operate in a silo. The business risk manager must act as a business partner—embedding with sales, operations, marketing, and product teams—interpreting their drivers through a financial lens and influencing their decisions. This is known as financial business partnering, where the finance function brings actionable insight to other departments rather than just numbers.

For example, when marketing proposes an initiative, the finance leader can work with them to model ROI, customer acquisition costs, and margin sensitivity; or when operations proposes capital expenditure, finance can evaluate its effect on cash flows and working capital. By gaining the trust of other functions, the finance manager can guide resource allocation toward the most value-enhancing initiatives.

Performance Measurement & Key Metrics

“What gets measured gets managed.” To ensure growth initiatives stay on track, the finance manager must design and track a focused set of key performance indicators (KPIs) aligned with strategic goals (e.g. revenue growth rate, gross margin, customer lifetime value, return on invested capital).

But measurement is not enough—timely variance analysis (comparing actual vs budget vs forecast) is crucial. The finance leader should dig into the root causes of deviations, recommend corrective action, and continuously update forecasts based on real feedback loops. This keeps the organisation agile and responsive.

Risk Management & Strategic Safeguards

Growth often entails risk—financial, operational, market, and regulatory. A strategic finance manager must identify, assess, and mitigate risks proactively. Some tools include hedging, scenario stress tests, sensitivity analyses, contingency reserves, and robust internal controls.

For example, if a business plans expansion into a volatile currency region, the finance manager could assess foreign exchange exposure, define thresholds, and recommend hedging or contractual clauses to guard against adverse swings. Similarly, they might stress-test liquidity under recession scenarios to ensure the company can survive downturns while still investing selectively.

Strategic M&A, Partnerships & Growth Through Acquisition

As businesses scale, organic growth may not suffice. A seasoned finance manager often contributes to mergers, acquisitions, or strategic partnerships—evaluating target valuations, synergy potential, financing structures, and post-merger integration. In many organisations, the finance/strategy role overlaps with corporate development.

Even in smaller firms, the finance leader can spot potential synergies (e.g. distribution capability, technology, customer overlap) and propose acquisition pathways, run due diligence models, and assess whether the long-term gains outweigh risks.

Communication, Storytelling & Stakeholder Alignment

A Business Finance Manager insights are only effective if communicated clearly. It is essential to translate financial analysis into compelling narratives for senior leadership, the board, or external stakeholders (investors, lenders). This means crafting visual dashboards, summary “teaser” slides, and bulletproof executive-level recommendations—always linking recommendations back to business strategy.

For example, when presenting a multi-year investment plan, the finance leader should tell a high-level story (“Investing in new product line A yields 25 % incremental margin and accelerates market share in Asia”) but also be ready to show backup detail (sensitivity, risk, assumptions). Strong communication builds credibility and helps align diverse stakeholders around a coherent growth agenda.

Capabilities and Mindset: What Differentiates a Strategic Finance Leader

To execute the above levers effectively, the finance manager must cultivate certain capabilities and a mindset shift:

Strategic orientation: Think beyond the next quarter; always tie financial decisions to long-term value creation.

Curiosity and cross-functional fluency: Be willing to learn the drivers of marketing, operations, product, supply chain, etc.

Analytical rigour: Be fluent in modelling, scenario analysis, probability, sensitivity, and financial math.

Adaptive mindset: Business conditions shift; be ready to pivot when assumptions change.

Communication skills: Able to distil complexity into clarity and persuade non-finance stakeholders.

Proactivity and ownership: Don’t wait for requests—anticipate growth dilemmas and propose solutions.

Ethics and integrity: Decisions must respect internal controls, compliance, and transparency.

When finance operates this way, it elevates from a supporting arm to a driver of competitive advantage.

Final Thoughts

In summary, a modern Business Finance Manager who transcends traditional accounting tasks can become a strategic growth engine in an organisation. By embracing scenario modelling, capital allocation, business partnering, performance tracking, risk management, M&A involvement, and powerful storytelling, the finance function can transform from “scorekeeper” to trusted growth driver.

If you’re a finance professional or an aspiring leader who wants to deepen your strategic finance skills and build that mindset, you might consider structured professional development. Programs like the Certificate Program offered by IADM Academy can help you acquire curated frameworks, tools, and the strategic thinking necessary to step into that elevated role.

Frequently Asked Questions

What is the primary role of a Business Finance Manager in strategic growth?

A Business Finance Manager supports strategic growth by aligning financial planning with business objectives. They analyse scenarios, allocate capital efficiently, manage risks, and provide insights that shape long-term strategies.

How does financial planning help in driving business growth?

Through detailed forecasting and scenario modelling, finance managers help leadership make informed decisions, identify potential risks, and allocate resources to the most profitable opportunities.

Why is cross-functional collaboration important for finance managers?

By collaborating with departments like marketing, operations, and sales, finance managers can integrate financial perspectives into decision-making, ensuring every growth initiative is financially sound.

What strategic tools do finance managers commonly use?

They use tools such as NPV, IRR, sensitivity analysis, variance analysis, and financial dashboards. These tools support data-driven strategies and improve organisational agility.

How can professionals develop strategic finance skills?

Professionals can pursue advanced certifications or structured programs like the IADM Academy Certificate Program to gain strategic financial planning, leadership, and analytical skills for growth-focused roles.

Jasmin R.

The Data Protection and AI Governance course was practical, up-to-date, and taught by experienced professionals. I gained skills I could apply immediately, and within months, I landed a better role with more responsibilities!

Serena A. Wagner

Thanks to IADM’s Neurodiversity course, I now truly understand how to support employees with ADHD. I can identify their strengths, navigate challenges, and create a more inclusive work environment. The course was practical, insightful, and easy to apply

Sebastian Köhler

I took the Cybersecurity Awareness course at IADM and was genuinely impressed by how closely it reflected real-world challenges. From phishing risks to data protection, every module was hands-on and immediately applicable. IADM gave me the confidence!

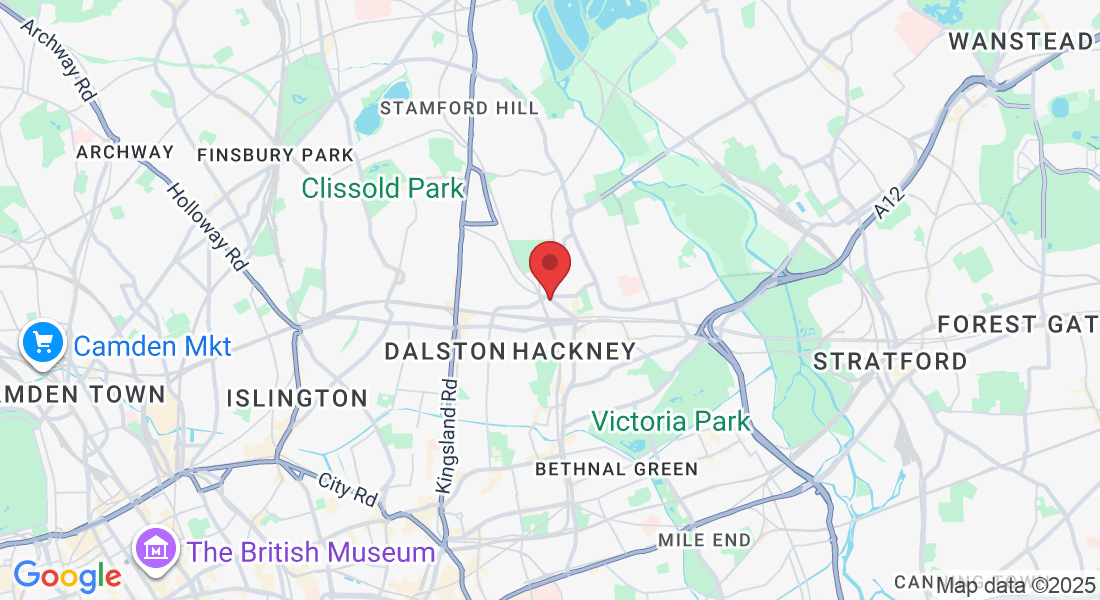

IADM Ltd

Suite 10, Capital House

61 Amhurst Road

London

E8 1LL

United Kingdom

Main Line (Phone & WhatsApp):

+44 7347 588566

Managing Director/Founder: Nurgül Aslan MBA, M.Sc.

Germany/Europe